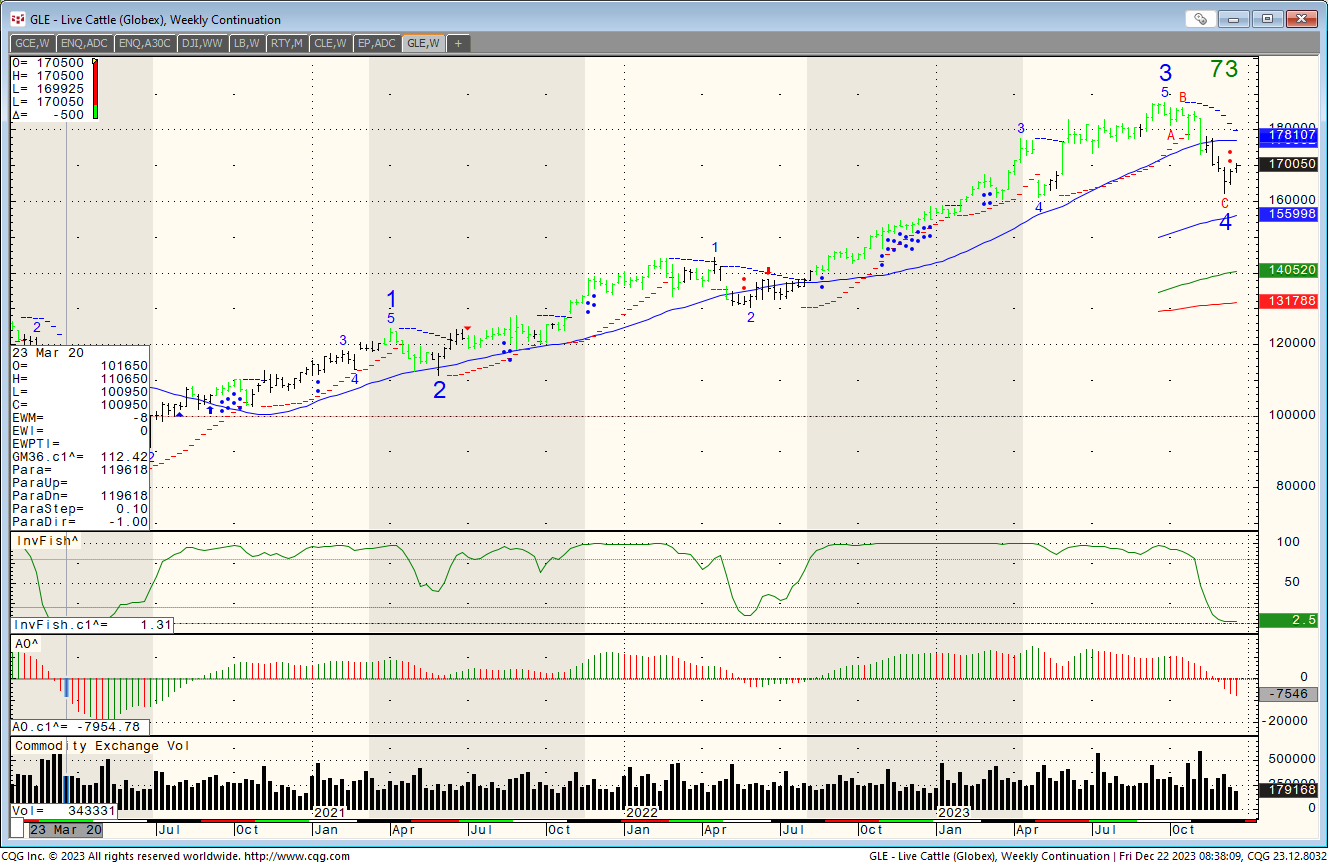

If prices follow-through after this initial reversal, seasonal tailwinds could help prices really accelerate to the upside. Seasonality: It’s worth noting that these potentially bullish developments are occurring as prices enter what’s seasonally their strongest 3 month period of the year (May-July). Tactically we want to be long this market only if prices remain above this confluence of resistance on a daily closing basis and want to be taking profits near 170. Prices closed back above the downtrend line from the early April highs and the December lows to confirm the bullish momentum divergence and failed breakdown.

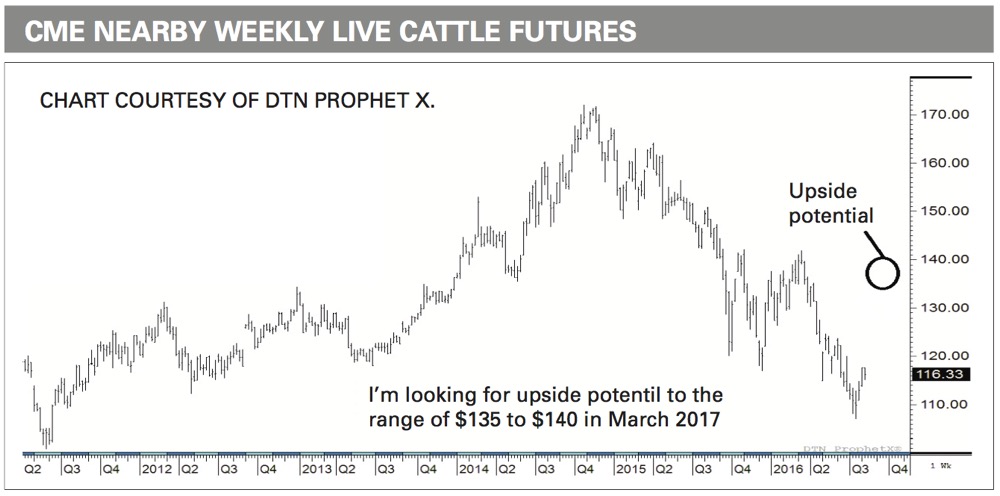

The daily chart provides a more tactical view of this failed breakdown. As long as prices are above the December lows on a weekly closing basis, we want to be approaching this market from the long side. Normally we want to avoid markets with flat 200 period moving averages, but in this case we can utilize the failed moves that result from them to our advantage. The upside target for this potential move would be the YTD highs near 170. If this sharp reversal back above the December lows holds until the end of the week, it would confirm that bullish divergence and failed breakdown from a structural perspective. Last week prices made new marginal lows as momentum diverged positively. Structurally, prices have been stuck in the 145-170 range since breaking the uptrend line from the November 2009 lows. It currently sits at near 3 year lows and is down 15% for the year, but recent price action suggests this market could be setting up for a monster squeeze to the upside. This form is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.From the desk of Tom Bruni across the commodities complex has been a significant theme throughout 2016, but Feeder Cattle has not participated to the upside at all this year. Spam protection has stopped this request. Posted by Smith at 5:02am November 2, 2020 If you are reading this, you are most likely aware, so spread the word to other producers that they should take advantage of this program. We learned this spring that the biggest COVID-related threat to cattle markets was processor shutdowns, so avoiding those this winter will be key.įinally, I continue to hear from folks who are unaware of the direct payments in the Coronavirus Food Assistance Program (CFAP) and have not signed up for the second round of these payments (CFAP 2.0).

In truth, I really don’t think consumer demand has been a major issue this year, but the impact on the foodservice market has been felt on upper end meats. As the economy recovers from COVID, beef demand should also improve. And, a smaller calf crop will help improve prices somewhat. As I look to 2021, I see no reason to think that beef cow numbers won’t be down again. The year 2020 has been a year of constant transition and adjustment, which tends to weigh on any market. Source: USDA-AMS, Livestock Marketing Information Center, and Author Calculationsįigure 2: 550 lb Medium / Large Frame #1-2 Steers Groups and higher quality feeder have not fallen as much and remain in the $130’s. On a state average basis, an 850 lb M/L #1-2 steer has moved into the low-mid $120’s.

#NOVEMBER FEEDER CATTLE FUTURES CHART FULL#

It really wasn’t until the last two weeks of the month that full price impact was felt in Kentucky markets, so figure 1 really doesn’t show the extent of the drop over the last couple weeks. Consistently rising corn prices have also weighed on feeder markets as that impacts feed costs this winter. Spring CME© live cattle futures also dropped sharply throughout the month, which worked to pressure heavy feeder cattle prices in KY. Seasonally, weights tend to peak in late November or early December.įed cattle prices decreased slightly from the first of the month, which is a counter-seasonal move. Dressed steer weights continue to run about 3% above last year. Beef cow slaughter has remained pretty high since summer, but dairy cow slaughter has been down over the same time. Federally inspected cattle slaughter remains around 2019 levels. October has not been kind to cattle producers and traditional seasonal factors have been amplified this year by uncertainty over the election and back-and-forth discussions about another round of stimulus funds. Kenny Burdine, Livestock Marketing Specialist, University of Kentucky

0 kommentar(er)

0 kommentar(er)